Food industry & Scope 3: A state of the art of food supply chain emissions

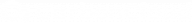

Scope 3 emissions are taking (rightfully and finally) center stage and the food industry is talking the talk. Since 2016, Scope 3 disclosures from food companies in CDP have increased by 113%. With more supply chain emissions disclosed, we should be seeing Scope 3 emissions reductions around now, right? …Right?

We combed through the CDP 2022 Global Supply Chain Report to get the snapshot of Scope 3 emissions, zooming in to the 1020 CDP-reporting food companies. Here’s what the data tells us about the state of food supply chain emissions.

💪 The good stuff:

Scope 3 emissions disclosure to CDP in 2022 is present in 9 out of 10 food reporting companies, a 38% increase since 2021 and a 90% since 2020. The data shows that Scope 3 disclosures trend is increasing by 42%compared to 2020.

Out of the food companies that do disclose Scope 3 emissions, 62% include some form of primary data from the supply chain, a percentage that seems relatively stable compared to the 60% in 2020, and 62% in 2021.

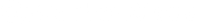

In 2022, 44.2% of the Scope 3 reporting food companies reported reductions in supply chain emissions. Shifting the focus on supply chain emissions is now best practice.

😬 The not-so-great stuff:

CDP’s data is illustrative of the big issue: In 2022, 1 out of 4 food companies dedicated enough to disclose their emissions still have no primary data from the supply chain and in absolute terms, the number of these companies is increasing.

Nevertheless, the increased number of companies in no possession of primary data can be easily interpreted: As more food companies are starting to disclose supply chain emissions, it is almost expected to start with a screening. This can have a positive light, as the focus is shifting from “report with perfect data” to “well begun is half done“.

In terms of reductions throughout the scope, the food industry is in tight control of its own backyard but cannot say the same for the supply chain. Half of the companies reporting on their supply chain emissions reduced their Scope 1 and 2 emissions, but saw their Scope 3 emissions increase. Only 1.3% of the reporting companies managed to reduce emissions throughout all scopes.

What about walking the talk?

The answer is hard-printed in the data. Out of those who do report Scope 3 emissions, 44.2% of them saw their supply chain emissions increase, equaling the number of food companies increasing their Scope 3 emissions.

The food industry is in tight control of its own backyard but not of its supply chain. Half of the companies reporting on their supply chain emissions reduced their Scope 1 and 2 emissions but saw their Scope 3 emissions increase.

The percentage of food companies reporting a) increased emissions in at least one Scope or in any combination of two Scopes, or b) no changes in their baseline is a staggering 48.7%, leaving only 1.3% of the reporting food companies reporting emissions reductions in all 3 Scopes.

💡 The insights:

The not-so great data highlight the discrepancy between knowing the importance of supply chain emissions and acting on supply chain emissions. The percentage of companies without any primary data potentially explains the lagging supply chain reductions, especially when compared to the increasing number of companies reporting overall and the trend in emissions reductions in Scopes 1 and 2. In a few words…

The food industry knows just how critical it is to reduce Scope 3 emissions but has not managed to impactfully attack them yet.

🎯 And the reason?

There are three potential explanations: Either the food industry cannot pinpoint the emissions hotspots along the supply chain, or doesn’t have a way of effectively engaging their supply chain or knows where emissions are and doesn’t have effective reduction initiatives in place.

The challenge of practically tracking supply chain emissions doesn’t come as a shock. A recent study in Nature identified 3 main obstacles to mapping Scope 3 emissions:

- Lack of regulations

- Data privacy concerns

- Lack of infrastructure

As marketing people addressing you right now, we can -sadly- agree that the statement “We are setting up an infrastructure for our supply chain emissions” is far less marketable than the sexier “We are committed to net-zero emissions by 2050“. It is no wonder that Elon Musk named his infrastructure company The Boring Company.

This is merely telling of the food industry’s maturity: Climate strategy and targets are brand safety leverage. However, reducing emissions where they are -the deep ends of the supply chain- is not an issue of marketing or branding. It is a question of financial survival for those who start early, an opportunity to thrive.

🔧 How do we fix it?

But the fact remains: If food companies want to reach their emissions reduction targets, they need to focus sharply on supply chain emissions, map them out to an actionable level of detail, and work with their suppliers to reduce them. It takes commitment, as any change management does, but it is doable, and most importantly it is far more accessible than the CDP data displays. In terms of digital infrastructure for food supply chain emissions, what can be automated, has been automated.

Committed wholesalers like Out of Home and Menigo, the Sysco subsidiary have already started the Scope 3 infrastructure work and are advancing in leaps and bounds (stay tuned for their skyrocketing progress). If you are ready to leave the frustration behind and do the same as Out of Home and Menigo, here is how you can get started 👇

Related Posts

ESG Reporting: Navigating ESG frameworks & requirements

Learn all about ESG reporting standards to promote transparency, impress your stakeholders, and boost your brand. What Does ESG Reporting Mean? Why Is ESG Reporting Important For Companies? Mandatory

Climate Action in the Food Industry: Half-Baked Efforts as 44% of Companies Remain at Initial Maturity Level

An in-depth analysis of 83 global companies in the food system reveals mixed levels of maturity along 6 dimensions of climate performance, but with a projected positive trajectory of climate action in

Nordic Seafarm: A jack of all trades ingredient, an ace in climate performance

What’s your first thought when you think of seaweed? And no, it can’t be maki rolls! Nordic Seafarm is here to make Nordic sugar kelp the top-of-mind ingredient. Multifaceted, bringing a wave of u

Cérélia: High experience standards, one recipe switch, and a 30% reduced climate footprint

Cérélia is a global leader in fresh dough and ready-to-eat pancakes headquartered in France but expanding globally, in both production and distribution. Cérélia has 12 factories in total, 9 in Eur