An in-depth analysis of 83 global companies in the food system reveals mixed levels of maturity along 6 dimensions of climate performance, but with a projected positive trajectory of climate action in the next few years.

- Almost half (44%) of the food companies analyzed are Problem-Aware, at the first maturity level of climate action, less than a quarter (23%) are at the second level of Solution-aware, and only 10% are at the third stage of Mobilizer, presently implementing their emissions reduction roadmap.

- 41% of food companies have advanced at the second level of maturity, Solution-Aware, with their Supply Chain Strategy, acknowledging the significance of the value chain for emission reductions.

- A signal of a positive trajectory for the operational dimensions is the plurality (43%) of food companies at the second and third level of maturity in Corporate strategy and Organizational Empowerment.

- Ingredient companies and producer companies display the highest level of maturity overall. No ingredient company was found without an active carbon management plan.

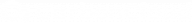

Figure 1: Distribution of maturity along the six dimensions, displayed in %. Data is cumulative for the four supply chain segments of the food system analyzed.

Ahead of the COP28 spotlight on the food system responsible for a third of global emissions, CarbonCloud conducts a first-of-its-kind maturity analysis on the climate action of the 83 largest companies at four stages of the food supply chain.

The analysis was conducted on the basis of the company’s maturity model of climate performance. The Climate performance maturity model identifies 4 levels of maturity for companies actively engaging the risk of climate change at each of the following dimensions:

- Corporate Strategy

- Supply chain strategy

- Data management

- Communication

- Climate Compensation/Offsetting

- Organizational empowerment.

The model was derived from prior academic research on emissions from the food system from the company’s founders and scientific board and is now available as a self-assessment for any business operating in the food system.

Figure 2: Distribution of maturity along the four levels and across the four supply chain segments of the food system analyzed, displayed in %.

Maturity Analysis per dimension: Supply chain emissions prevail, offsetting fades out

Climate corporate strategy (%)

Figure 3: Distribution of maturity along the dimension of Climate corporate strategy, displayed in %. Data is cumulative for the four supply chain segments of the food system analyzed.

Supply chain strategy (%)

Figure 4: Distribution of maturity along the dimension of Supply chain strategy, displayed in %. Data is cumulative for the four supply chain segments of the food system analyzed.

Corporate Climate Strategy (43%) and Organizational Empowerment (43%), the two prerequisite dimensions for near-term climate action display higher levels of maturity than operational dimensions such as Data Management, where 50% of the companies are either problem-aware or not tackling the issue yet (flee).

However, the importance of the supply chain in food system emissions management is rapidly acknowledged. The peak of the maturity curve in supply chain strategies is further along than any other dimension. 44% of the companies being Solution-aware or Mobilizers, already implementing reduction initiatives in the supply chain, slightly outnumbering the first stage of maturity (39%) or supply chain inaction (4%).

Data management (%)

Figure 5: Distribution of maturity along the dimension of Data management, displayed in %. Data is cumulative for the four supply chain segments of the food system analyzed.

Communication(%)

Figure 6: Distribution of maturity along the dimension of Communication, displayed in %. Data is cumulative for the four supply chain segments of the food system analyzed.

While the supply chain transparency capabilities are rather developed for the social impact of the supply chain and for deforestation on high-risk commodities, food companies have not yet scaled these capabilities for climate performance data or for the full assortment. A large portion (46%) of the companies analyzed still calculate supply chain emissions based on screenings or manually consolidated data.

External communication of climate performance is still narrative-driven, convoluted with other sustainability categories, or quantified but unverified (67%). At the same time, the food industry is drifting away from accounting for carbon offsets in their climate performance, most probably due to the recent negative press on carbon offsets and legislations around “carbon neutrality” claims. 39% of the companies analyzed do not mention carbon compensation at all as part of their external communication or sustainability reports.

Carbon compensation / Offsetting (%)

Figure 7: Distribution of maturity along the dimension of Carbon compensation/Offsetting, displayed in %. Data is cumulative for the four supply chain segments of the food system analyzed.

Organizational empowerment (%)

Figure 8: Distribution of maturity along the dimension of Organizational empowerment, displayed in %. Data is cumulative for the four supply chain segments of the food system analyzed.

Advancing maturity in the food system is imperative for effective climate action. Our model is the labor of years of research turned into a roadmap for elevated climate performance, meaningful change, and a resilient food supply chain. With this maturity assessment of the market, we hope to guide companies in the food system to transform carbon management into a business opportunity,

says David Bryngelsson, CEO & co-founder of CarbonCloud, and lead author of the Climate Performance Maturity Model.

Segment Analysis Reveals Varied Maturity Levels: Ingredient Companies and Retailers/Grocers Lead the Way

– Retailers/grocers

Figure 9: Distribution of maturity along the six dimensions for the supply chain segment of Retailers/Grocers analyzed in the study, displayed in %.

All Retailers/Grocers appear to have a climate action plan and active carbon management, except for the Offsetting dimension. In Corporate Strategy, the majority is Problem-aware (60%) but the next immediate plurality (20%) is Mobilizers, at the third maturity level. This inverted bell curve diverges from the linear adoption in other dimensions and segments, revealing a higher maturity discrepancy.

Retailers/Grocers displayed the highest level of maturity in Data Management, with over a third of them (35%) being Solution-aware (29%) or already Mobilizing (6%) towards climate data infrastructure and supply chain primary data. Their position towards the consumer-facing end of the supply chain and further away from the majority of food emissions at farm appears to be an urgency lever for data management.

– Food & Beverage producers

Figure 10: Distribution of maturity along the six dimensions for the supply chain segment of Food & Beverage producers analyzed in the study, displayed in %.

Food & Beverage Producers displayed the largest variety among the different maturity levels, grouping the most and least mature companies in all six dimensions.

– Ingredient companies

Figure 11: Distribution of maturity along the six dimensions for the supply chain segment of Ingredient companies analyzed in the study, displayed in %.

Overall, Ingredient companies appear to be at the optimal starting point for development. All of the Ingredient Companies analyzed acknowledged and accounted for climate performance. No Ingredient Company was found without a climate action plan, targets, or active carbon management operations (0% flee).

In Corporate Strategy, the majority (44%) is Problem-aware, but the next immediate plurality is Mobilzers (33%), at the third maturity level. This inverted bell curve diverges from the linear adoption in other dimensions and segments, revealing a higher maturity discrepancy.

– Wholesalers/Distributors

Figure 12: Distribution of maturity along the six dimensions for the supply chain segment of Wholesalers/Distributors analyzed in the study, displayed in %.

The wholesalers/Distributors segment is currently at initial levels of climate performance maturity but is projected for a hopeful future. High levels of maturity (Solution-aware, Mobilizers) are cumulative in Corporate Strategy (39%) and the operational dimensions of Data management (34%) and Organizational Empowerment (27%).

In Data Management, 34% of Wholesalers/ Distributors are Solution-aware (17%) or already Mobilizing (17%) towards climate data infrastructure and supply chain primary data. Their position towards the consumer-facing end of the supply chain and further away from the majority of food emissions at farm appears to be a lever of urgency for data management.

Take CarbonCloud’s 3-minute Maturity Assessment survey to find your starting point and how to level up.

Methodology

The food system was segmented into 4 categories along the food value chain: Ingredient Companies, Food & Beverage Producers, Wholesalers/Distributors, and Retailers/Grocers. The top 20 (±4) largest companies per revenue were identified for each segment. The analysis was performed on the most recent information including Annual Financial Reports, Annual ESG reports and CDP reports when openly accessible. The assessment was performed on occurring actions and not on future-looking statements or initiatives. Transparency and reporting quality were not assessed in this analysis: Companies with comprehensive, transparent reports and clear distinction between future-looking statements and present initiatives may be assessed on a lower maturity level based on their present initiatives. Conversely, companies with opaque reporting where no information was provided for adequate analysis were excluded from the assessment but included in the data analysis with NA (No Answer). The final numbers were rounded up to the nearest whole number.