No sustainable grocer wants to constantly produce reports. The Grocer’s Complete Guide to Emissions Reporting was created to put the “Which ESG standard?” question to rest and enable grocers to focus on sustainable action.

A robust stance against climate change has been a must-have for European and American grocers for at least the last 5 years. Market forces, consumer attitudes, investor pressure, and the grocers’ own risk analysis have driven rapid growth of emissions strategies and sustainability budgets among grocers.

This guide was designed to help grocers refocus from complying with reporting requirements to real climate action. Untangle all the ESG acronyms, see what applies to grocers, and most importantly, understand what is a must with each standard.

An overview

- Introduction

- Mandatory disclosures

- Market-mandatory disclosures

- Voluntary Disclosures

Download The Grocer’s Guide to Emissions Reporting and simplify your ESG reporting

Introduction

A robust stance against climate change has been a must-have for European and American grocers for at least the last 5 years. Market forces, consumer attitudes, investor pressure, and the grocers’ own risk analysis have driven the rapid growth of emissions strategies and sustainability budgets among grocers. However, the speed of development and the lack of standardization in emissions reporting are driving grocers keen to cement their resilience to search for a guiding star in a sky of standards and acronyms.

In this landscape, grocers are commendably mature in their reporting. The vast majority of the largest European and American grocers already conform to and report based on a line-up of different standards. Until 2023, target and reporting initiatives have been voluntary. As markets introduce mandatory climate disclosures in the coming years, with the UK starting already in 2023, grocers, with multinational market ubiquity may need to familiarize themselves with a new standard.

The swift uptake of emissions reporting is indicative of the prime opportunity to level up and track climate performance. However, as reporting standards are piling up, reporting is turning into an objective in itself. What differentiates these reporting standards is often methodological decisions. These choices require operational knowledge of climate science that grocers asked to decide do not and need not have to manage their emissions effectively. Nevertheless, the issue of compliance remains, prompting grocers to tick the box and move on to doing things instead of reporting what they do.

There are two key actions a grocer can take to bring substance back into emissions reporting:

- Have an actionable, segmented emissions inventory for their company and portfolio that facilitates initiatives and reporting,

- Dedicate a few minutes to understand what aspect of a reporting standard applies to them and how.

Emissions inventories for grocers have some fundamental constants:

- The majority of emissions -up to 90%- is in the supply chain, i.e. Scope 3.

- The majority of those are from purchased goods and services, i.e. their product portfolio.

- Supplier engagement is the most impactful climate mitigation initiative grocers can take to demonstrate climate action.

However, even with these constants, the emissions inventory is singular for every grocer. On Constant #1, CarbonCloud’s emissions management platform can deliver an actionable and compliant emissions inventory and automatic supplier engagement capabilities for grocers. On Constant #2 CarbonCloud can help grocers untangle all the acronyms in sustainability standards, see what applies to their specific sector, and most importantly, understand what they need to do after each standard comes into effect.

How to use CarbonCloud’s Sustainability Standards Guide for Grocers

The purpose of this guide is to assist grocers in which reporting standard to follow, how, and what each can do for their operations. The guide categorizes and briefly presents the most credible voluntary and all mandatory emissions reporting standards. A kind reminder: Reporting standards are not Pokémon, so you really don’t need to catch them all! The same applies to this guide. It is essential to prepare for the mandatory standards but not all voluntary standards may be applicable to your business so you can navigate those accordingly. Finally, this guide is developed to accommodate the constants of a grocer’s emissions inventory so extra focus is placed on standards relating to Scope 3 and particularly compliant calculations and reports for the Purchased Goods and Services category.

FRAMEWORKS USED IN MANDATORY DISCLOSURES

GHG Protocol

Date of birth:

Late ‘90s.

Creators:

The World Resources Institute (WRI), the World Business Council for Sustainable Development (WBCSD)

Goal:

To address the lack of a standardized method for greenhouse gas accounting.

Grocer-applicable standards & guidance issued:

- Corporate Standard Corporate-level GHG emissions inventory

- Corporate Value Chain (Scope 3) Standard Assessment of Value Chain Emissions

- Product Life Cycle Standard Understanding of a product’s life cycle emissions

- Scope 2 guidance Measurement of emissions from purchased or acquired electricity, steam, heat and cooling

- Land Sector and Removals Guidance (draft) Accounting for land management, land use change and CO2 land storage

Relation to other standards:

Accepted by CDP, GRI, SBTi, ISO 14064-1 and ISO 14064-2 national and market climate disclosures, PEF, TCFD, and many others.

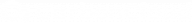

GHG protocol is the organization issuing a range of standards for different applications. Its standards and guidance are close to ubiquitous in sustainability reporting. On a company level, as of 2016, 92% of the Fortune 500 companies responding to the CDP used GHG Protocol directly or indirectly. The Corporate Standard, Corporate Value Chain (Scope 3) Standard and Scope 2 guidance are the most widely accepted ways to calculate and categorize the emissions inventory of a corporation. These 3 standards also originated the must-know categorizations of Scope 1, 2, and 3 emissions.

Scope 1

GHG emissions from the operations and activities that the company owns and directly controls.

Scope 2

GHG emissions come from the energy used for the operations and activities that the company owns and directly controls.

Scope 3

All the greenhouse gas emitting activities that occur across the entire value chain, both before (upstream) and after (downstream) the company’s operations.

* Scope 3 emissions are classified in 15 categories. For grocers, the most significant one and the majority of their emissions inventory is Purchased goods and services, i.e., all emissions associated with the production of the products you sell until they reach your company.

Example company: ACME groceries

Scope 1: Grocery stores, distribution centers, fleet, corporate offices.

Scope 2: Energy used at company-operated buildings for lighting, cooling etc.

Scope 3: Emissions from the production of all products sold in the store, their transportation towards ACME, emissions from the production of hardware used in the stores and corporate office, emissions from the use and disposal of the purchased products by consumers.

As GHG protocol states, the standards listed above are “separate but complementary”. At a company level, the sum of the life cycle emissions of all products in the portfolio combined with additional scope 3 categories (e.g., employee commuting, business travel, and investment) approximate the company’s total GHG emissions (scope 1-3). The Value Chain Standard (Scope 3) and the Product Standard are interconnected on delivering on both goals and execution.

For grocers, engaging suppliers to perform emissions calculations of their products based on the Product Life Cycle Standard is at the core of supplier engagement. A life cycle assessment for the hundreds of products in a grocer’s portfolio is not something any grocer should do as part of their Scope 1 or 2 emissions management but it is at the core of their Scope 3 inventory and total emissions. Emissions calculations of products based on the Product Life Cycle Standard are what your suppliers should provide to grocers as part of the supplier engagement initiative

Deep Dive on the GHG Protocol Product Life Cycle Standard

As the graph above demonstrates, a holistic corporate emissions inventory is a pyramid with the Product Life Cycle Standard in its basis. The Product Life Cycle Standard is user-friendly guidance on how what a product carbon footprint analysis that is not prescriptive on most methodological choices but specified requirements on formatting, data quality, and scope. The per-product report or carbon footprint result your suppliers provide you should conform with the following:

— Attributional approach

Emissions are attributed to the product by linking the processes that generate GHG emissions across its life cycle. As opposed to the consequential approach the potential impacts of changes in the supply chain are described which focuses on gathering global knowledge.

— Specified data quality

Data quality is not prescriptive, i.e. primary data is not a requirement for the study but a data quality evaluation is required based on the following five indicators: • Technological representativeness: Data that reflects the actual technology used in the process

- Geographical representativeness: Data that reflects the actual geographic location of the processes (e.g., country or site)

- Temporal representativeness: Data that is up to date (e.g., year)

- Completeness: How statistically representative of the process sites the data is

- Reliability: How dependable your sources, data collection methods, and verification procedures are.

— Specified scope and system boundaries (supply chain stages included)

A choice of scope or system boundaries is not prescribed but it needs to be explicitly stated.

CarbonCloud's recommendation

At this stage, it is difficult to surpass the GHG Protocol’s Standards and Guidances so it is not really an option. However, this is good news as all of them are comprehensible and user-friendly and most services and emissions intelligence platforms conform with them already. In most cases, the alternative option to GHG Protocol’s Standards and Guidances is the ISO 14000 family which is way more extensive, not more prescriptive and has sustainability craftspeople as their main audience.

Good to know about GHG Protocol and SBTi FLAG 💡

Forest Land and Agriculture emissions targets will be mandatory for any company with SBTi-validated targets. Under SBTi’s guidance, the Forest Land and Agriculture Guidance (FLAG) accepts GHG Protocol’s draft of Land sector and removals guidance to account for land-related removals and land use change emissions. The draft states that reporting removals requires primary data from the operation itself. 👉 Conforming with the GHG protocol’s Land sector and removals guidance requires grocers to have primary data from every farm.

ISO 14000

Date of birth:

1996

Creators:

The International Organization for Standardization (ISO), the British Standards Institute (BSI)

Goal:

Support businesses to:

- Minimize the environmental impact of operations.

- Conform to laws, regulations, and other requirements.

- Improve in both of the areas above

Grocer-applicable standards & guidance issued:

For GHG accounting

ISO 14064-1: Corporate GHG inventory

ISO 14064-3: Validation and verification of GHG statements

ISO 14067: Quantification of carbon footprint of products

Relation to other standards:

Accepted by CDP, GRI, SBTi, ISO 14064-1 and ISO 14064-2 national and market climate disclosures, PEF, TCFD, and many others.

ISO 14000 is a group of standards that cover any aspect related to environmental management and all subsequent processes – verification, validation, communication etc. The ISO 14000 family was created to solve the issue of lack of comparability as different companies set up their own ways of environmental management. However, the comparability issue still prevails, as, like the GHG protocol, ISO is not prescriptive about methodological choices that can affect the impact of food products in particular.

The Scope of the ISO 14000 family is large as it covers sustainability overall and includes guidance on many impact categories separately and in combinations. The sub-family that focuses exclusively on GHG emissions is the ISO 14060 group. The ISO 14060 group of standards provides guidance for quantifying, reporting, and reducing greenhouse gas emissions as well as the processes around it. It ranges from how to set up a corporate GHG inventory (ISO 14064- 1) to how to develop a product carbon footprint (ISO 14067) and how to validate and verify GHG statements (ISO 14064-3). ISO 14065 sets requirements for validation and verification bodies, and ISO 14066 defines competence requirements for GHG validation teams and verification teams

Closer look at 14064 - Corporate GHG inventory

ISO 14064-1 is the guidance on how to quantify a company’s greenhouse gas emissions. This is quite close to the GHG protocol standard for Corporate Accounting and Reporting Standard (Scope 1) and includes the same Scope categorization, emissions metrics, and clarifications -but not prescriptions on data quality. Inventory calculations based on ISO 14064-1 are accepted as a basis for reporting for CDP, SBTi, and TCFD-aligned disclosures mandated by governments and markets.

ISO 14064-3 provides additional guidance on how to verify statements related GHG inventories. The verifier gathers evidence, reviews the GHG information system, evaluates the GHG statement, and compares the report against the verification criteria for consistency and accuracy.

Deep dive at 14067 – Quantification of carbon footprint of products

ISO 14067 is guidance on what an ISO-conforming life cycle assessment should include with climate change as the only impact category. This set is close to the GHG Protocol Product Standard and produces the same result: The carbon footprint of a product.

As is the case with the GHG protocol Product Life Cycle Standard, an emissions inventory that includes value chain emissions and conforms to ISO 14064-1 has at its basis the carbon footprint calculations of all the products in the portfolio. To follow through fully with the ISO pathway, your suppliers should perform these calculations for their products and provide you with the report according to the ISO 14067 guidance.

An ISO 14067-conforming report is the analysis of a carbon footprint study and includes the standard LCA sections on results, data, methods, assumptions and life cycle interpretation of the study. Regarding the data input, an ISO 14067-conforming analysis must include a life cycle inventory with input data from all the supply chain gates included in the study.

The life cycle inventory must be accompanied by an analysis of the input data and how it aligns with the allocation method used in throughout the study. There is no qualitative requirement for the data input (e.g. primary or secondary) but:

- Representative data must be accompanied by a reference list and a third-party verification

- Input data should align with the allocation method used throughout the study

- Data quality and certainty level must be stated and assessed based on the following criteria:

- time-related coverage

- geographical coverage

- technology coverage

- precision

- completeness

- representativeness

- consistency

- reproducibility

CarbonCloud's recommendation

As ISO 14064 and 14067 are usually alternative options to the GHG Corporate Standard, Value Chain Standard and Product Life Cycle Standard, we recommend the latter as they are more user-friendly, action-focused, are aimed at corporations and businesses and it is easier to find services that conform.

Good to know about the ISO 14000 family

As many grocers have prior experience with ISO certifications, it’s good to know that in the 14000 family, ISO itself does not own the conformity assessment. In other words, companies do not get a certification from ISO itself. ISO has a neutral policy on conforming in this family and conformity assurance can be made according to the criteria listed in the family either by the company itself or a third party.

Task Force for Climate-Related Financial Disclosures (TCFD)

Date of birth:

2015

Creators:

The Financial Stability Board (FSB)

Goal:

To Inform investors about corporate climate change mitigation and governance.

Grocer-applicable standards & guidance issued:

TCFD recommendations on climate-related financial disclosures.

Relation to other standards:

CDP, national and market climate disclosures, GHG protocol (corporate, scope 2, value chain), ISO 14064-1, 14064-2.

The TCFD recommendations are the go-to format for companies reporting on their climate change strategy and metrics. It is adopted by SBTi founding member and the world’s largest climate disclosure framework, CDP, and by 35 nations and public markets mandating climate-related disclosures. The urgency for grocers to familiarize themselves with the TCFD reporting framework -if they haven’t already- is high, as the mandate takes effect for the largest organizations in the next 2 years, depending on the market.

Having said that, a TCFD-aligned report has many similarities to annual financial reports that grocery organizations are already well-acquainted with. In fact, many sustainability reports are already structured in a way that aligns with the TCFD recommendations. Moreover, the CDP questionnaire that many grocers are already submitting yearly is structured to formulate a report that follows the TCFD recommendations.

Deep dive into the TCFD recommendations

The TCFD recommendations are rather straightforward yet cover the entire vertical of a company’s work with climate change – from top to bottom. The four areas your TCFD-aligned report needs to include are:

Governance

The organization’s governance around climate-related risks and opportunities.

Strategy

The actual and potential impacts of climate-related risks and opportunities on the organization’s businesses, strategy, and financial planning.

Risk Management

The processes used by the organization to identify, assess, and manage climate-related risks.

Metrics and Targets

The metrics and targets used to assess and manage relevant climate-related risks and opportunities.

1. Governance

TCFD recommends companies disclose the following information in the Governance section.

1. The Board’s oversight on climate-related issues

- What processes your Board have in place to oversee climate issues and how frequently they take place.

- How the Board is informed on the progress against your climate targets and goals.

- How climate issues are integrated into your overall business processes and ventures.

2. Management’s role in assessing and managing climate issues

- What the climate-related responsibilities are in your management team.

- How your organization is structured.

- What are the processes for information exchange and monitoring on climate-related issues?

2. Strategy

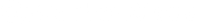

While a strategy can encompass anything and everything, the TCFD recommendations outline a clear idea of where a robust corporate climate strategy should stem from: Risks and Opportunities. In this section, retailers will delineate what risks and opportunities your organization has identified and how it is managing or leveraging them.

TCFD advises companies to outline climate-related risks and opportunities on short-, medium-, and long-term, and if appropriate, according to geography.

In addition, TCFD identifies 3 categories of risks and 5 areas of opportunities that limit the scope and make the content of your report more tangible.

Once your risks and opportunities are appropriately categorized, TCFD recommends 3 points of disclosure:

3. Disclose the climate-related risks and opportunities your company has identified

In this section, account for in short-, medium-, and long-term and define the time horizons.

4. Describe the impact of each risk and opportunity on your financial planning

i.e. How your company budgets to mitigate the identified risks and leverage the identified opportunities. Specifications may include impact on your products, supply chain, current financial position, and the allocated financial resources for R&D, and adaptation and mitigation activities.

5. Outline the resilience of your company based on climate change scenarios

The scenarios should be described in detail and the section should include how the risks and opportunities may impact your company in each scenario.

Good to know about the TCFD scenarios

Scenarios are a divergent topic in emissions-related reporting. While it is useful to assess future states while accounting for uncertainty, it is resource-intensive. That’s why TCFD has a stronger scenario recommendation for non-financial institutions with a revenue of over $1 billion. Scenario-analysis is also not mandatory in all market disclosures.

3. Risk management

The natural next step after you have identified the potential risks is what your company is doing to address them. TCFD recommends disclosing the following in this section, disclose:

6. How your company identifies and assesses the risks included in your strategy

In this section, also describe how you assess the significance of climate-related risks in relation to other risks.

7. How your company manages and prioritizes climate-related risks

8. How climate-related risks are integrated in your overall risk management

4. Metrics

The metrics and targets section is not only the basis of the strategy development, it is also the most heavily quantified section of a TCFD-aligned report. TCFD is not too prescriptive when it comes to methodological choices. For the sake of convergence, it requests inventory calculations to follow the GHG protocol relevant standards and categorization in Scopes 1, 2, and 3

Good to know about the TCFD metrics

Grocers and other companies with food-heavy inventories are encouraged to include metrics on climate-related risks associated with water, energy, land use, and waste management. However, TCFD is NOT requesting metrics on these impact categories but emissions metrics that may impact them.

The last 3 recommendations of TCFD outline the metrics that your company chooses to support your strategic planning and monitoring of your operations:

9. Share the metrics your company uses to assess climate-related risks and opportunities

These should align with your Sections B. Strategy and C. Risk management.

10. Share your Scope 1, 2, and possibly 3 GHG emissions inventory

11. Outline your targets on climate-related risks and opportunities and your yearly performance against them

In your target delineation, you should include both absolute and intensity targets, the time frame for each (medium-, long-term and interim targets), the base year, and the associated KPIs.

MARKET- & NATION-MANDATED CLIMATE RELATED FINANCIAL DISCLOSURES

Date of effect:

2025 for FY 2024 – for companies already reporting with the NFRD framework

2026 for FY 2025 – for companies with

- over 250 employees

- over €40 million in net sales

- over €20 million balance sheet total

2027 for FY 2026 – for listed SMEs

2028 for FY 2027 – for non-EU companies with

- at least one subsidiary operating in the EU

- sales in the EU of over €150 million

Reporting standards accepted:

The EU is developing its own set of reporting standards, ESRS, which are based on the Global Reporting Initiative (GRI) and Standards and the Sustainability Accounting Standards Board (SASB) Standards, and the report is aligned with TCFD.

- For emissions inventories: ISO 14064-1, ISO 14044, ISO 14067, GHG Protocol Corporate Standard, Scope 2 Guidance, Corporate Value Chain (Scope 3) Accounting and Reporting Standard

Report content:

ENVIRONMENT – 6 topical standards:

- Climate change

- Pollution

- Water and marine resources

- Biodiversity and ecosystems

- Resource use & circular economy

SOCIAL – 4 topical standards

- Own workforce

- Workers in the value chain

- Consumers and end-users

- Affected communities

GOVERNANCE – 1 topical standard

Business conduct.

The European Union reporting mandate is the most divergent from other markets, yet the most extensive. To start with, CSRD is the only national mandate that requires reporting for sustainability overall and not just climate change and emissions. CSRD covers environmental, social and governance, most specifically the 6 objectives listed above.

All these topical standards are at the moment in draft mode and are due to be developed further by EFRAG. The exposure drafts were sent to the EU member states and bodies in June 2023 and you can check out some useful videos on every draft here.

Deep dive into ESRS 1 – Climate change

Zooming on climate change, the format calls for 3 general areas – inspired but not fully aligned with the TCFD framework.

GENERAL DISCOSURES

- Integration of sustainability-related performance in incentive schemas

- Transition plan for climate change mitigation

- Material impacts, risks and opportunities, and their interaction with strategy and business model

- Description of processes to identify and assess material climate-related impacts, risks and opportunities

IMPACT, RISK, AND OPPORTUNITY MANAGEMENT

- Policies related to climate change mitigation and adaptation

- Actions and resources in relation to climate change policies

METRICS AND TARGETS

- Targets related to mitigation and adaptation

- Energy mix and consumption

+intensity per revenue

- Gross Scope 1, 2, 3 total emissions

+intensity per revenue

- GHG removals and mitigation projects via carbon credits

- Internal carbon pricing

- Possible financial effects from physical and transition risks and opportunities

Good to know about CSRD

Scope 3 inventory Companies are asked to calculate it or screen it in full (all 15 categories of the GHG protocol Value Chain Standard) but you may disclose only significant categories. Double materiality Companies must perform double materiality, i.e. assess risks the company poses to sustainability and risks the company may face from outcomes of unsustainable practices. Double materiality is a unique divergence in CSRD. ISO 14067 CSRD takes a life cycle approach and the accepted standard for life cycle assessments is ISO 14067. Publishing CSRD disclosures may be integrated in your sustainability report and hosted on your website. Auditable data Data submitted to CSRD should be audited. Until the full rollout of CSRD in 2028, limited assurance is permitted but after 2028, reasonable assurance will be required. This is also unique in CSRD.

Name:

Climate-related financial disclosures for companies and limited liability partnerships (LLPs)

Date of effect:

2023 for FY 2022 – for companies with

- Publicly tradable securities,

- Banks and insurance companies,

- Private companies with over £500 million in turnover and over 500 employees

2025 for FY 2024 – across the economy

Reporting standards accepted:

Fully aligned with TCFD

- For emissions inventories: GHG Protocol Corporate Standard, Scope 2 Guidance, Corporate Value Chain (Scope 3) Accounting and Reporting Standard

Report content:

Governance, Strategy, Risks & opportunities, Metrics

Scopes

Scope 1 and 2 emissions – Scope 3 emissions mandatory only after the first reporting year

The UK has extensive clarifications on climate-related disclosures, including comprehensive guidelines. To start with, the climate-related disclosures will be part of the existing strategic report.

When it comes to the content of the report, the how and what are additions to the TCFD guidelines in focus:

- Filers need to address how risks and opportunities

- are identified, assessed, managed, and integrated into the company’s overall risk management, as TCFD suggests,

- Related to the company’s operations, over what time period, and with what impact

- How the company’s climate targets address the identified risks and opportunities and over what time horizon

- The company’s KPIs and metrics to assess progress against the specified targets, as well as the calculations on which the KPIs and metrics are based.

- Filers must include a scenario-based resilience analysis

The guidelines also specify that companies need to disclose all Scopes with Scope 3 being optional for the first reporting year.

Finally, the guidelines provide additional details on how to manage data gaps in emissions metrics.

- Companies must identify consistent data gaps and prioritize engagement to ensure data quality improvement

- If a company has incomplete data, it may use modeling for the majority in CO2e

- Greenhouse gas emissions must be disclosed in absolute terms and in CO2e

- Greenhouse gas emissions must be disclosed in terms of intensity in climate footprints

Name:

SEC Climate-Related Disclosures

Date of effect:

2024 for FY 2023 – for large accelerated filers

2025 for FY 2024 – for accelerated and non-accelerated filers

2026 for FY 2025 – for smaller reporting companies

Reporting standards accepted:

Fully aligned with TCFD

- For emissions inventories: GHG Protocol Corporate Standard, Scope 2 Guidance, Corporate Value Chain (Scope 3) Accounting and Reporting Standard

Report content:

Governance, Strategy, Risks & opportunities, Metrics

Scopes

Scope 1 and 2 emissions – Scope 3 emissions are mandatory if a) material, b) the company has set relevant targets.

If a registrant has a relatively ambitious Scope 3 emissions target, but discloses little investment in transition activities in its financial statements and little or no reduction in Scope 3 emissions from year to year, these disclosures could indicate to investors that the registrant may need to make a large expenditure or significant change to its business operations as it gets closer to its target date, or risk missing its target. Both potential outcomes could have financial ramifications for the registrant and, accordingly, investors.

The Enhancement and Standardization of Climate-Related Disclosures for Investors, SECURITIES AND EXCHANGE COMMISSION

Following the TCFD and GHG protocol guidelines, starting 2024, American companies will need to disclose the following:

- Strategic, financial, and operational climate impact including

- methodology, data sources, and assumptions

- Their material impact

- How these risks affect the company’s strategy, business model, and outlook

- How they are identified assessed, managed, and integrated in the company’s overall risk management

- Governance and risk management

- Including responsibilities and expertise per role and the related processes.

- Physical, regulatory, technological and reputational climate-related risks

- GHG emissions on Scope 1 and 2 as well as Scope 3 if it is material, which for retailers it is, or if the company has a Scope 3 target

- In absolute terms

- In terms of intensity

- Per unit of revenue ($)

- Per unit of product

- Plus, the methodology and breakdown per greenhouse gas

Requiring a registrant to describe its methodology for determining its GHG emissions should provide investors with important information to assist them in evaluating the registrant’s GHG emissions disclosure as part of its overall business and financial disclosure. Such disclosure should enable investors to evaluate the reasonableness and accuracy of the emission disclosures, and should promote consistency and comparability over time.

The Enhancement and Standardization of Climate-Related Disclosures for Investors, SECURITIES AND EXCHANGE COMMISSION

- Targets and transition plans, including

- Offsets – The bill specifies that if offsetting is classified as a primary reduction strategy, the company is flagged by investors as “high risk”. The use of offsets needs to be outlined in detail and the quality of the offsets must be included in the risk identification

- Renewable credits

- Low-carbon product revenue

- Potential internal carbon price – If the company has an internal carbon prices, it needs to specify:

- The measurement boundaries for CO2e

- The price

- The change of price over time, and

- The rationale

Good to know about SEC Climate-related disclosures

Materiality is not the easiest concept to grasp if one is not already familiar with it but in very broad terms and in this case, it refers to aspects that are relative to climate change –i.e. either affect or are affected– and significant. The bill defines “material” as follows:"As defined by the Commission and consistent with Supreme Court precedent, a matter is material if there is a substantial likelihood that a reasonable investor would consider it important when determining whether to buy or sell securities or how to vote."

VOLUNTARY TARGETS & DISCLOSURES

Date of birth:

2015

Creators:

CDP, the United Nations Global Compact, World Resources Institute (WRI) and the World Wide Fund for Nature (WWF)

Goal:

Validation of corporate emissions reductions targets in line with the Paris Agreement to limit global warming

Grocer-applicable standards & guidance issued:

SBTi cross-sector pathway

SBTi FLAG

Relation to other standards:

GHG Protocol Corporate Standard, Scope 2 Guidance, Corporate Value Chain (Scope 3) Accounting and Reporting Standard, CDP, ISO 14064-1, 14064-2.

SBTi is a climate target validation organization. The term “Science-based” comes from aligning target criteria with “limiting global warming to well-below 2°C above pre-industrial levels and pursue efforts to limit warming to 1.5°C”. While SBTi tracks the progress of companies against those targets and strongly recommends annual reporting and a linear reduction trajectory year after year, SBTi does not sanction companies that do not perform according to their recommendations. However, SBTi may recall its validation or not approve targets.

Case study

Amazon submitted its pledge to SBTi in 2019. During this meantime, any submitting company needs to develop specific targets for SBTi to approve. In early 2020, SBTi defined the timeline between committing and submitting targets to 24 months. Since 2019 when Amazon first committed to SBTi, the company’s emissions increased by 40%. In August 2023, Amazon’s commitment was removed from SBTi. According to Amazon, “the new methodologies and requirements for submission make it difficult to submit targets in a meaningful and accurate way”. According to SBTi, “It’s disappointing that some companies are failing to meet the expectations of initiatives like the SBTi”.

Source: Los Angeles Times, Amazon, SBTi

SBTi Must-haves

– Targets must be revalidated every five years.

– Targets under the “well-below 2°C” pathway must be resubmitted to align with the 1.5°C pathway as SBTi is phasing out the “well-below 2°C” pathway.

– Grocers must submit FLAG targets. This is in effect for any targets set after April 2023. For Grocers with approved targets, they must submit FLAG targets by the end of 2023, if they have set SBTi before January 2020, or by the end of 2024 if they have set SBTi between 2020 and April 2023.

– Long-term (net-zero) targets must be accompanied by near-term targets that are minimum 5 and maximum 10 years ahead. The opposite is not mandatory.

– Scope 1+2 targets are mandatory and must cover 95% of emissions. Scope 3 near-term targets that cover 2/3 of value chain emissions are also mandatory, if the scope 3 emissions inventory is over 40% of the total emissions – which is the case for grocers.

– Emissions inventory must be submitted for all Scopes and all 15 categories of Scope 3.

– Base year must be after 2015.

Closer look at SBTi Cross-sector pathway

The cross-sector pathway is aimed at companies that operate in an industry without sector-specific guidance. Cross-sector targets are absolute, meaning that the company commits to reducing emissions irrespective of the production output of the company. A grocer can select its SBTi targets based on the following matrix of interconnected factors.

Type

Companies setting science-based targets may choose to set absolute targets, intensity targets, renewable electricity targets, engagement targets, or any combination of the above.

Time horizon

Long-term targets have a net-zero ambition and a 2050 time limit. SBTi strongly recommends that companies commit to a long-term target, which they deem of higher ambition. What this target practically means is that the company needs to reduce emissions by at least 90% by 2050.

Near-term targets have a timeframe of a minimum of 5 and a maximum of 10 years and enable a company to formulate more specific ambitions. Your company may set near-term targets without long-term targets, which is a popular option among retailers. However, if a net-zero target is your ambition you are required to also develop near-term targets.

Forest, Land and Agriculture Guidance (FLAG) is guidelines released by the Science-Based Targets initiative on how to set emissions reduction targets for activities along their value chain that involve forestry, land use and agriculture, which amount to 22% of global emissions. FLAG targets cover the portion of emissions until the farm gate, require submission of the relevant emissions inventory with farm stage as the boundary, and they are required for companies with activities in agriculture, animal sourcing, food processing, and food retail – or companies with over 20% of FLAG-related emissions in Scopes 1, 2, 3.

FLAG targets are divided into two sets:

The whole sector approach

The whole-sector approach involves reducing emissions from FLAG-related products and activities altogether.

– Time horizon

Whole-sector targets may be near-term, covering the next 5-10 years or long-term targets to reduce at least 72% of FLAG emissions by no later than 2050. Near-term FLAG targets are set in a separate tool provided by SBTi while long-term targets presently apply only to emissions from agriculture in the “Net-zero tool” that covers general targets.

– Scopes

The threshold is reduction of minimum 95% for Scopes 1 + 2 targets and reduction of at least 2/3 of emissions for Scope 3 targets.

– Deforestation clause

Guidance for long-term forestry emissions will be released later on however, all companies committing to FLAG-targets by default also commit to zero deforestation by 2025, at latest.

Near-term targets have a timeframe of a minimum of 5 and a maximum of 10 years and enable a company to formulate more specific ambitions. Your company may set near-term targets without long-term targets, which is a popular option among retailers. However, if a net-zero target is your ambition you are required to also develop near-term targets.

The commodity approach

The commodity approach involves emissions from 11 major commodities with a high carbon footprint. The 11 commodities are: Beef, chicken, dairy, leather, maize, palm oil, pork, rice, soy, wheat, and timber & wood fiber.

In general, companies with a diverse portfolio, like grocers, are encouraged to use the general FLAG targets. However, grocers may use the commodity approach, which is available for companies serving end-consumers or companies with more than 10% of their FLAG emissions in one commodity but are not required to do so.

– Type

Commodity targets can be in absolute terms, reducing emissions by a fixed amount e.g. 20% reduced emissions from beef by 2030, or in terms of intensity, reducing emissions relative to an economic or operative unit, e.g. 20% reduced emissions per frozen burger sold by 2030.

CDP

Date of birth:

2000

Creators:

Independent non-profit organization

Goal:

A global disclosure system for investors, companies, cities, states and regions to manage their environmental impacts.

Grocer-applicable standards & guidance issued:

Climate Change, Water, Forests

Relation to other standards:

GHG Protocol Corporate Standard, Scope 2 Guidance, Corporate Value Chain (Scope 3) Accounting and Reporting Standard, ISO 14064-1, 14064-2.

CDP, formerly known as Carbon Disclosure Project, is a non-profit organization of, among other things, annual corporate emissions disclosures. CDP enjoys a spike in its popularity during the last years, with over 18,000 companies reporting in 2022 and over 870 retailers submitting the CDP questionnaire.

The CDP offers a range of different areas of disclosure, with climate change being the most prominent. CDP disclosures are filled in in a questionnaire format that follows the TCFD structure of Governance, Strategy, Risk management, and Emissions and metrics. After a company has submitted the questionnaire, a disclosure report is generated and submitted to CDP for scoring.

Depending on the actions a company takes on the 4 areas and the level of stewardship over their emissions and data, CDP provides each company with a score ranging from A to F.

Good to know about CDP and SBTi

CDP was a founding member of SBTi. Companies that validate their targets with SBTi are strongly recommended to disclose their emissions and progress against their SBTi targets annually through CDP but it is not mandatory. However on this note, when a company discloses that their climate targets are SBTi validated, it is scored higher.

Conclusion

Turns out reporting standards have more in common than just acronyms. These are some key takeaways for grocers that can safely apply to all existing emissions reporting standards and are likely to apply to any newly emerging standard.

- The goal of climate reporting, be those annual emissions, strategies, targets, product footprints is to increase corporate accountability and transparency around climate change.

- Supply chain emissions are critical, for every company but even more so for grocers, and overarchingly acknowledged as such.

- Corporations cannot take their proper share of accountability without supply chain transparency and supply chain transparency for grocers starts at a product level.

- Data quality is another overarchingly acknowledged challenge but the response for corporations is not prescriptive or evaluative. There is no emissions reporting standard that requires primary data from the supply chain or a certain data quality to report. If anything, most standards require the responding company to acknowledge their data quality so that they can increase it.

- A staple across climate and emissions reporting standards is an emissions inventory. Any grocer that has a robust emissions inventory across all Scopes is geared up for a successful climate strategy and reporting conformity.

- The goal of climate reporting, be those annual emissions, strategies, targets, product footprints is to increase corporate accountability and transparency around climate change.

The challenge with grocers is twofold:

A) A grocer is further away from the deep end of the supply chain, aka the majority of emissions. Managing these emissions is up to a grocer’s suppliers and their suppliers all the way to farm. In this respect, engaging suppliers to report emissions and propagate the work to their suppliers is a grocer’s best bet.

B) A grocer’s product portfolio can be as high as tens of thousands of products. The calculation of a grocer’s portfolio emissions must be automated to be a feasible project. In the same vein, grocers need to start with emissions data that is actionable-enough and scalable-a-lot, to support increasing data quality. This also means that, to increase data quality across the supply chain grocers and their suppliers need to work on the same infrastructure, with ensured trade secret privacy, and automated engagement capabilities.

Responding to these challenges in a systematic way, sets grocers up for success – surely with emissions reporting, be that voluntary or mandatory; certainly with managing and reducing their emissions.

Motivated to get started with your emissions inventory?

Enhance your ESG reporting journey with robust data that simplifies compliance. Reach out to our experts to find out how.