Scope 3 emissions are increasingly in the spotlight, and the food industry is beginning to address the issue. Since 2016, Scope 3 disclosures from food companies within the CDP have risen by 113%. With the growing transparency surrounding supply chain emissions, one might expect to see corresponding reductions in Scope 3 emissions at this stage. However, are these reductions being realized?

A while ago, we combed through the CDP 2022 Global Supply Chain Report to get the snapshot of Scope 3 emissions, zooming in to the 1020 CDP-reporting food companies. Now that we’re about to end 2024, have things improved?

But first, here’s what the report tells us about the state of food supply chain emissions.

Positive Developments

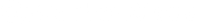

Scope 3 emissions disclosure to CDP in 2022 is present in 9 out of 10 food reporting companies, a 38% increase since 2021 and a 90% since 2020. The data shows that Scope 3 disclosures trend is increasing by 42% compared to 2020.

Out of the food companies that do disclose Scope 3 emissions, 62% include some form of primary data from the supply chain, a percentage that seems relatively stable compared to the 60% in 2020, and 62% in 2021.

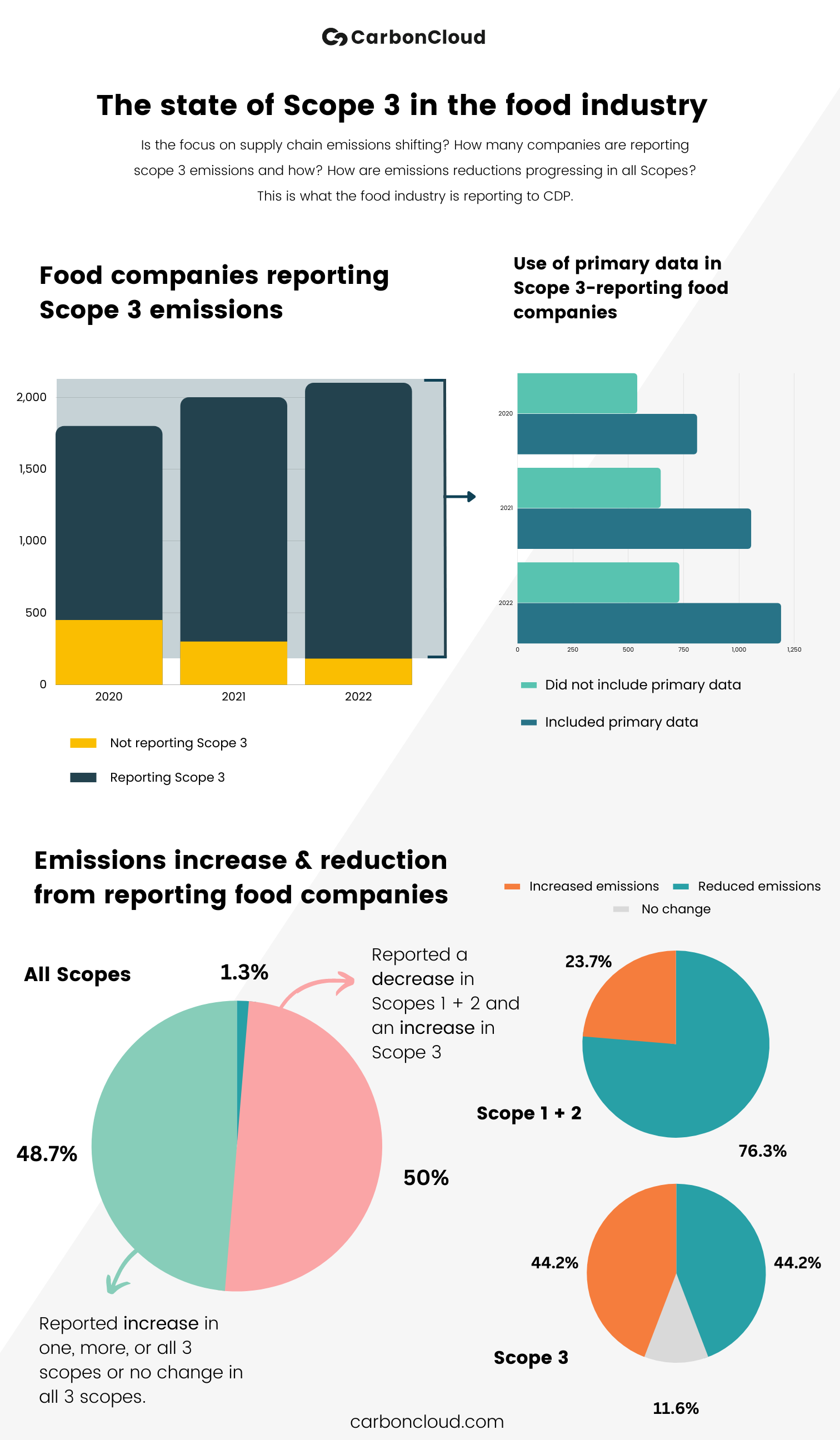

In 2022, 44.2% of the Scope 3 reporting food companies reported reductions in supply chain emissions. Shifting the focus on supply chain emissions is now best practice.

Areas of Concern

CDP’s data is illustrative of the big issue: In 2022, 1 out of 4 food companies dedicated enough to disclose their emissions still have no primary data from the supply chain and in absolute terms, the number of these companies is increasing. In 2024, collecting primary data is still a challenge.

Nevertheless, the increased number of companies in no possession of primary data can be easily interpreted: As more food companies are starting to disclose supply chain emissions, it is almost expected to start with a screening. This can have a positive light, as the focus is shifting from “report with perfect data” to “well begun is half done“.

In terms of reductions throughout the scope, the food industry is in tight control of its own backyard but cannot say the same for the supply chain. Half of the companies reporting on their supply chain emissions reduced their Scope 1 and 2 emissions, but saw their Scope 3 emissions increase. Only 1.3% of the reporting companies managed to reduce emissions throughout all scopes.

The Challenge of 'Walking the Talk'

The answer is hard-printed in the data. Out of those who do report Scope 3 emissions, 44.2% of them saw their supply chain emissions increase, equaling the number of food companies increasing their Scope 3 emissions.

The food industry is in tight control of its own backyard but not of its supply chain. Half of the companies reporting on their supply chain emissions reduced their Scope 1 and 2 emissions but saw their Scope 3 emissions increase.

The percentage of food companies reporting a) increased emissions in at least one Scope or in any combination of two Scopes, or b) no changes in their baseline is a staggering 48.7%, leaving only 1.3% of the reporting food companies reporting emissions reductions in all 3 Scopes.

Key Insights

The data reveals a critical disconnect: while food companies recognize the importance of addressing supply chain emissions, many have yet to implement effective strategies to reduce them. A notable factor contributing to this delay is the lack of primary data from many companies, which complicates efforts to identify and target emissions hotspots along the supply chain.

This lag in reduction efforts, especially when compared to progress in Scope 1 and 2 emissions, highlights the complexity of addressing Scope 3 emissions. In short:

The food industry understands the urgency of reducing Scope 3 emissions but has not yet devised and implemented comprehensive strategies to tackle them effectively.

Discover how businesses assess their corporate carbon footprint and take action. Looking for product-specific insights? Learn more about product carbon footprint here!

The Root Causes

There are three primary factors contributing to the slow pace of Scope 3 reductions in the food industry:

- Difficulty in Identifying Emissions Hotspots: Many companies struggle to pinpoint where the highest emissions occur within their supply chains.

- Limited Supplier Engagement: Effectively engaging suppliers to reduce emissions across the supply chain is a significant challenge.

- Insufficient Reduction Initiatives: Even where emissions sources are identified, many companies lack robust programs to reduce them.

This challenge is not unique to the food industry. A recent study in Nature identified three key obstacles to mapping and managing Scope 3 emissions:

- Lack of regulations

- Data privacy concerns

- Insufficient infrastructure

It’s worth noting that addressing these challenges is not always glamorous or marketable. While bold commitments like “Net-zero by 2050” are widely promoted, the less visible work of establishing the infrastructure necessary to reduce supply chain emissions is often overlooked. However, this groundwork is essential for the long-term success of any climate strategy.

Moving Forward: What Needs to Be Done?

If food companies are to achieve their emissions reduction targets, they must shift their focus to Scope 3 emissions. This requires mapping supply chain emissions with a high level of detail and working closely with suppliers to implement effective reduction measures. Although this is no easy task, it is entirely feasible. The infrastructure needed to support supply chain emissions reductions is largely in place, and many companies have already made significant progress.

Companies such as Out of Home and Menigo, a Sysco subsidiary, are already leading the way in building the necessary infrastructure to manage Scope 3 emissions. Their success demonstrates that progress is possible, and more companies can follow suit.

If your company is ready to move beyond frustration and take meaningful action on Scope 3 emissions, the path forward is clear: invest in supply chain transparency, collaborate with suppliers, and commit to long-term emission reductions. By doing so, you will not only meet your environmental goals but also gain a competitive advantage in an increasingly climate-conscious market.