ESG Standards Explained: Corporate Sustainability Reporting Directive (CSRD)

The European Union’s Corporate Sustainability Reporting Directive (CSRD) is mobilizing ESG reporting for the food and beverage market. But there is another good reason to look at CSRD closely: CSRD is a completely novel ESG reporting framework.

- What is CSRD?

- What is the scope of CSRD?

- How does CSRD relate to other ESG frameworks?

- Who reports under CSRD and when?

- Sticky notes on CSRD

- Benefits of CSRD

What is the Corporate Sustainability Reporting Directive (CSRD)?

The Corporate Sustainability Reporting Directive (CSRD) is the European Commission’s reporting directive on corporate sustainability issues. Ostensibly, the EU is calling companies to report on sustainability risks, opportunities, and management on financial terms. A CSRD report covers how your company prioritizes different sustainability issues, how much your company is spending to mitigate or leverage risks and opportunities, and the expected results.

What is the scope of CSRD?

The scope of CSRD reporting covers to sustainability overall, covering all aspects of E (environment), S (social) and G (governance). Most other national or market mandates localize the scope of the disclosures to climate change and emissions management.

In general, the scope of a CSRD report covers the company’s impact on sustainability during the fiscal year, and the budget and initiatives for the reporting year and the near future. At the top of every CSRD report is the double materiality assessment, an analysis of how your company impacts and is impacted by different sustainability risks. The different sustainability areas are listed below and each of them has its own standard developed by the European Financial Reporting Advisory Group (EFRAG).

ENVIRONMENT

Environment has 5 topical standards on:

- Climate change

- Pollution

- Water and marine resources

- Biodiversity and ecosystems

- Resource use & circular economy

SOCIAL

Social has 4 topical standards on:

- Own workforce

- Workers in the value chain

- Consumers and end-users

- Affected communities

GOVERNANCE

Governance has only one topical standard on Business conduct.

Read our expert guide on how to prepare your CSRD report, what is mandatory to include, and how your company should approach it.

How is CSRD different from other reporting frameworks?

Emissions disclosures are becoming mandatory in 35 nations and markets representing 56% of the global GDP but there is one market that has been causing quite a stir. The European Union’s Corporate Sustainability Reporting Directive (CSRD) is mentally mobilizing the food and beverage market. But there is another good reason to look at CSRD more closely than the others: CSRD is different from the other national-level mandates but rather alike with other prominent ESG reporting frameworks.

😬 What other ESG frameworks?

Brush up on the most common ESG reporting frameworks & standards and stay on top of the acronyms!

CSRD & TCFD

Since the other national mandates are focusing on greenhouse gas emissions only, they all use some form of the TCFD framework and recommendations and focus only on climate change. CSRD is, we could say, inspired by the TCFD framework, covering your company’s oversight on sustainability issues and risk identification but the bulk of the report is much more action-oriented, focusing on risk management and mitigation and opportunity initiatives.

The CSRD Climate change (E1) sectopm covers all the disclosure recommended in the TCFD guidelines – and includes some additional metrics. In fact, ESRS 1, the cutting-sector mandatory standard on General requirements mirrors the TCFD architecture. This means your CSRD report should be more than conforming to TCFD and other national mandatory climate disclosures, which use the TCFD recommendations.

👉 National mandatory climate disclosures

Europe is not the only market mandating sustainability disclosures – Check out our complete guide of the 35 markets and nations making climate reporting mandatory!

EU Taxonomy (SFRD) & CSRD

SFRD or the EU Taxonomy is the financial sustainable reporting that is targeted to the financial market participants. In other words, SFRD focuses on any sustainable investments your company may have done and these activities classified per the EU taxonomy are a complementary report to CSRD.

Within SFRD, your company needs to report the details of every activity you are undertaking that contributes to an environmentally or socially sustainable objective. If you ask “what are these?”, the Commission has got your back.

All sustainable objectives are outlined in the EU taxonomy. More specifically, the 6 environmental objectives are:

-

-

- Climate change mitigation

- Climate change adaptation

- Sustainable use and protection of water

- Transition to a circular economy

- Pollution management

- Protection of biodiversity

-

Each activity you report should fulfill all of the following criteria:

-

-

- It should contribute substantially to one or more of the objectives.

- It should not cause significant harm to any of the remaining criteria.

- it should be carried out according to the European Union’s minimum safeguards.

- It should comply with the technical screening criteria for each objective.

-

The EU saved the curveball for last: Every activity you report should pass the technical screening criteria, which are outlined in a 300-page regulation document accompanied by a 600-page Annex for climate change adaptation and mitigation alone and are based on the lifecycle approach.

The good news is that food and beverage companies can localize their screening in sections 1, Forestry, and 2, Restoration of wetlands in the regulation and Agriculture of the Annex until more specific criteria are developed for agriculture in the future.

Fun (?) fact

Using CarbonCloud is an EU-taxonomy aligned activity under Engineering activities and related technical consultancy dedicated to adaptation to climate change. 👉 Learn more about how to find the right ESG software for your needs

GHG Protocol & CSRD

CSRD has based the scope definitions and calculation guidance of the GHG emissions for the E1 –Climate change standard on the following standards from GHG Protocol:

- Corporate Standard

- Scope 2 Guidance

- Product Life Cycle Standard

- Corporate Value Chain (Scope 3) Standard

The main difference between CSRD and GHG protocol lies in the boundaries. For GHG Protocol the boundaries outside a company’s financial control are defined as equity share, financial control, and operational control, whereas CSRD defines boundaries through operational control only.

👉 GHG Protocol explained

Read our GHG Protocol explainer for a short overview of the most widely accepted sustainability standard.

CSRD & GRI

The CSRD reporting standards were developed leveraging the GRI standard and, per EFRAG’s words, are fully aligned. However, there are 2 main additions in CSRD:

- GRI has only impact materiality while CSRD calls for double materiality.

- GRI allows value chain information to be omitted if it is not available whereas CSRD calls for value chain reporting and sets a qualitative standard on data.

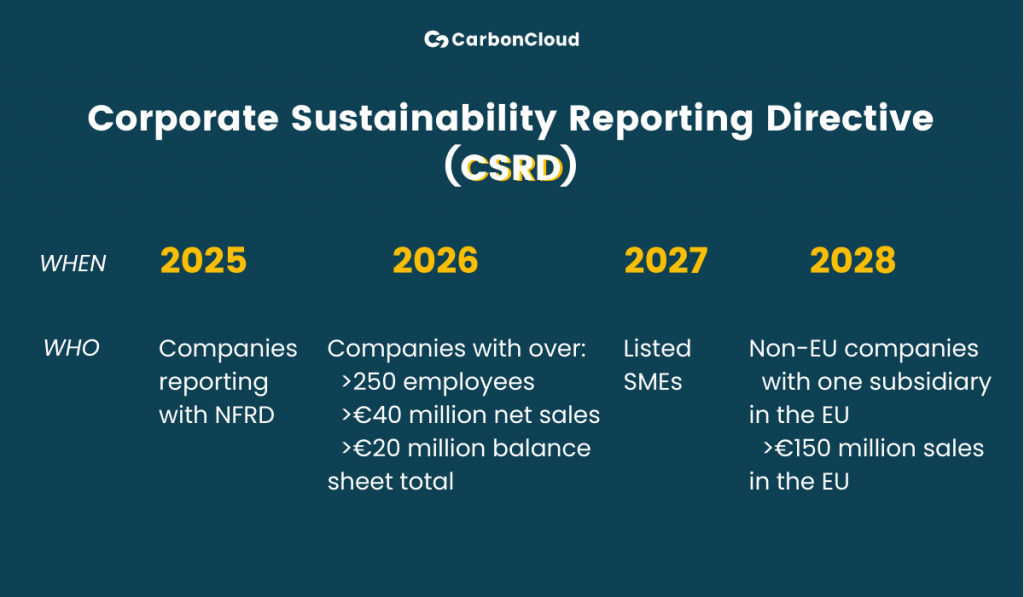

Who reports under CSRD and when?

Let’s clear this common misconception from the get-go: CSRD is currently in effect as a legislation but the report is not expected until earliest 2025. What is currently in effect is the Non-Financial Reporting Directive (NFRD). NFRD has been in effect since 2014 mandating large companies to disclose their sustainability performance alongside their annual financial reporting. When in effect, CSRD will replace NFRD and expand the scope of the reporting.

The European Commission published the final version of the directive in the official journal in December 2022. From this point forward, the nation members have 18 months to bring CSRD into national legislation. This is just in time for the first rollout phase of CSRD!

The first phase begins in 2025 for the financial year 2024 and affects companies already reporting with the NFRD framework. So in 2025, the companies will have to switch reporting framework.

The second phase rolls out in 2026 for the financial year 2025 and it expands to companies that fall under the following criteria:

- Have more than 250 employees

- Have over €40 million in net sales, or

- Have over €20 million balance sheet total

The third phase continues in 2027 for the financial year 2026 for listed SMEs.

The CSRD rollout concludes with the fourth phase in 2028 for the financial year 2027 for non-EU companies with at least one subsidiary operating in the EU and with sales in the EU of over €150 million.

Some points to keep in sticky notes

Scope 3 inventory

Companies are asked to calculate it or screen it in full (all 15 categories of the GHG protocol Value Chain Standard) but you may disclose only significant categories.

Double materiality

Companies must perform double materiality, i.e. assess risks the company poses to sustainability and risks the company may face from outcomes of unsustainable practices.

ISO 14067

CSRD takes a life cycle approach and the accepted standard for life cycle assessments is ISO 14067.

Publishing

CSRD disclosures may be integrated in your sustainability report and hosted on your website.

Auditable data

Data submitted to CSRD should be audited. Until the full rollout of CSRD in 2028, limited assurance is permitted but after 2028, reasonable assurance will be required.

How can a company benefit from CSRD?

It is easy to view CSRD as yet another reporting framework to tick the boxes but there will be multiple benefits from your CSRD report.

- Company reputation

Taking accountability for sustainability issues and initiative to mitigate your impact builds up your company’s credibility and reputation as a responsible company.

- Competitive advantage

A CSRD report is comprehensive which means that your company is transparently disclosing all its sustainability initiatives. Displaying responsible business practices differentiates your company as you report in detail how you go the extra mile.

- Stronger stakeholder engagement

The outline and progress of your sustainability strategy signal to investors that your company is resilient and apt to survive in our rapidly changing world. Moreover, your CSRD efforts are tied to a positive work environment which will make your own employees more engaged with their work and your company’s mission.

- Access to green capital

Green and sustainable investments are currently a massive capital pool that is bound to grow. Demonstrating your commitment to sustainable practices gives you quicker access to green capital – especially when you add your company’s EU taxonomy-aligned activities to your CSRD report.

- Risk mitigation & resilience

Climate change poses a high risk for corporate survival – particularly in the food industry, where your operations and value chain depend on the climate. Pinpointing sustainability risks, prioritizing them, and mitigating them makes your company hyper-prepared to survive and increases the resilience of your value chain.

All in all, CSRD is not just another ESG standard; it is indeed a change your company has to manage but with the right tools and a robust strategy, your CSRD report will become business as usual.

🙌 CarbonCloud is always here to help with ESG reporting!

If you could use some help discussing your CSRD report and data collection, contact our team of experts!

More standard-explainers?

Preparing your CSRD report

Preparing for CSRD? Join the club of over 50,000 companies required to report on sustainability! Talking to companies preparing for CSRD, we have observed that their biggest concern is the many unknow

ESG Reporting: Navigating ESG frameworks & requirements

Learn all about ESG reporting standards to promote transparency, impress your stakeholders, and boost your brand. What Does ESG Reporting Mean? Why Is ESG Reporting Important For Companies? Mandatory

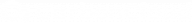

How to set SBTi FLAG targets – The Food Edition

The Forest Land and Agriculture Guidance from SBTi had retailers and food producers on the edge of their seats until its release in September 2022. Since April 2023 FLAG targets are a requirement and

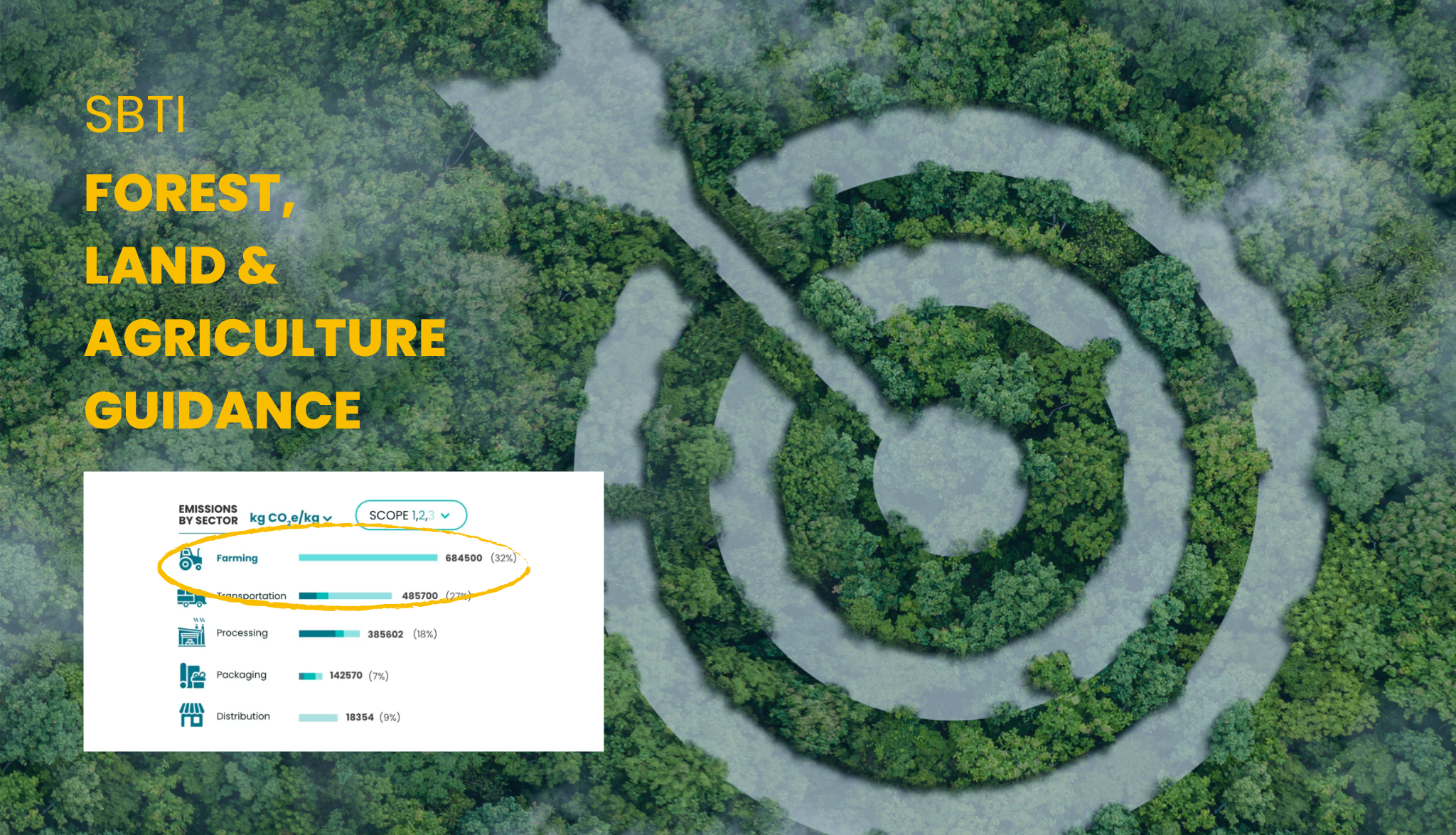

What are Scope 1,2,3 emissions?

The terms Scope 1,2,3 emissions are casually thrown around in the sustainability space – a bit too casually if you ask us. If you didn’t Google it the first time you heard it, you probably hav

ESG Standards Explained: Corporate Sustainability Reporting Directive (CSRD)

The European Union’s Corporate Sustainability Reporting Directive (CSRD) is mobilizing ESG reporting for the food and beverage market. But there is another good reason to look at CSRD closely: CSRD

Prev

Next

Related Posts

Sustainability Standards Explained: ISO 14000 family

Nothing says Standards like the International Organization for Standardization, also known to the business community as ISO. ISO is a popular and globally credible provider of standards for pretty muc

Triumf Glass boosts its sustainability work through collaboration with CarbonCloud

Triumf Glass and CarbonCloud partner up towards a more sustainable future. Through CarbonCloud’s research-based software service, Triumf Glass boosts the transparency of its carbon footprint all

Preparing your CSRD report

Preparing for CSRD? Join the club of over 50,000 companies required to report on sustainability! Talking to companies preparing for CSRD, we have observed that their biggest concern is the many unknow

From top to can: TENZING’s climate transparency climb

Traditionally, when people hear ‘energy drink’, they think of stunts with explosions, race cars, screaming faces, tons of sugar, chemical, and a poignant artificial flavor. Tense yet? Relax! TENZI