Sustainability Standards Explained: TCFD

The Task Force on Climate-Related Financial Disclosures (TCFD) Recommendations is the shadow ruler of ESG reporting. While the name “TCFD” may not ring a bell to everyone, the TCFD recommendations run on the undercurrent of emissions reporting behemoths, including CDP (Carbon Disclosure Project) and Climate-Related Financial Disclosures mandated by public markets and national governments. Today we go through the TCFD recommendations so definitely bring along your Business Controllers, optionally your CFO (if you don’t want to be running around at the end of the reporting year).

What is TCFD?

The Task Force on Climate-Related Financial Disclosures (TCFD) is a relatively new but widely established organization chaired by the Michael Bloomberg. TCFD was created in 2015 by the Financial Stability board – a memorandum created by G20 in 2009 as a response to the global financial crisis. The realization that brought TCFD to life is that “Climate change presents financial risk to the global economy” – amen. Consequentially, financial stakeholders require transparent, high-quality information on how companies manage climate change.

Enter TCFD. TCFD’s most famous work, the TCFD Recommendations, first published in 2017 and enhanced in 2021, are now the go-to reporting standard for companies reporting on their climate change strategy and metrics. It is adopted by SBTi founding member and the world’s largest climate disclosure framework, CDP, and by 35 nations and public markets mandating climate-related disclosures. So, if your company is not already familiar with the basics of the TCFD reporting framework, it will need to be soon – or right now, if you are a large or publicly-listed company.

All the ABCs of ESG in one place

New to ESG standards and reporting? Take it from the top 👉 Check out our complete guide to ESG Reporting Standards

What does a TCFD-aligned report include?

The TCFD recommendations are rather straightforward yet cover the entire vertical of a company’s work with climate change – from top to bottom. The four areas your TCFD-aligned report needs to include are:

- Governance

- Strategy

- Risk management

- Metrics & Targets

As TCFD’s own graph illustrates, the four areas build on one another bottom-up and are indicative of how businesses develop and monitor their climate strategy. These 4 areas come with a total of 11 recommendations for reporting. Let’s dig in.

TCFD has some light indications on reporting within the food industry, which we include in the following summary.

GOVERNANCE

TCFD recommends companies to disclose the following information in the Governance section.

The Board’s oversight on climate-related issues

1

- What processes your Board has in place to oversee climate issues and how frequently they take place. - How the Board is informed on the progress against your climate targets and goals. - How climate issues are integrated in your overall business processes and ventures.

Management’s role in assessing and managing climate issues

2

- What the climate-related responsibilities are in your management team. - How your organization is structured. - What the processes for information exchange and monitoring on climate-related issues.

Get the bullet points of every sustainability standard in your inbox

No need to run circles around the internet to understand what each sustainability standard is all about. Get it straight in your inbox, one explainer at a time!

STRATEGY

While a strategy can encompass anything and everything, the TCFD recommendations outline a clear idea of where your climate strategy should stem from: Risks and Opportunities. In this section, you will delineate what risks and opportunities your company has identified and how it is managing or leveraging them.

TCFD advises companies to outline climate-related risks and opportunities on short-, medium-, and long-term, and if appropriate, according to geography.

In addition, TCFD identifies 3 categories of risks and 5 areas of opportunities that limit the scope and make the content of your report more tangible.

Risks

Transition risks:

Transition risks refer to changes in the market landscape that may occur during the transition to a low-carbon economy and are divided into:

a) Policy and legal risks

Large regulatory-driven changes that may impact your operations.

b) Technology risks

Emerging technologies that may make your products or processes less competitive.

c) Market risks

Attitude shifts that may impact supply and demand.

d) Reputational risks

Changing perceptions that may hurt the reputation of your company and brand.

Physical risks:

Physical risks refer to changes in the physical environment that may occur as a result of climate change and impact your operations. When referring to physical risks, your report should specify the geography and the operations impacted. These are differentiated into:

a) Acute risks

e.g. wildfires, floods

b) Chronic risks

e.g. higher temperatures and rising of the sea-water level.

Opportunities

Here you may list any opportunities your company may leverage to mitigate or adapt to climate change. TCFD categorizes opportunities into:

a) Resource efficiency

Improving operational efficiency and reducing related costs.

b) Energy sources

c) Products optimized for lower emissions

d) New markets

d) Resilience-increasing initiatives and actions.

For food and beverage production, TCFD exemplifies additional opportunities such as low carbon and water intensity per unit and reduced input of residual waste.

Once your risks and opportunities are appropriately categorized, TCFD recommends 3 points of disclosure.

Disclose the climate-related risks and opportunities your company has identified

3

In this section, account for in short-, medium-, and long-term and define the time horizons.

Describe the impact of each risk and opportunity on your financial planning

4

In other words, how you budget for climate risks and opportunities. Specifications may include impact on your products, supply chain, current financial position, and the allocated financial resources for R&D, and adaptation and mitigation activities.

Outline the resilience of your company based on climate change scenarios

5

The scenarios should be described in detail and the section should include how the risks and opportunities may impact your company in each scenario. Scenarios are a divergent topic in emissions-related reporting. While it is useful to assess future states while accounting for uncertainty, it is resource-intensive. That’s why TCFD has a stronger scenario recommendation for financial institutions or non-financial institutions with a revenue of over $1 billion.

RISK MANAGEMENT

The natural next step after you have identified the potential risks is what your company is doing to address them. TCFD recommends disclosing the following in this section:

How your company identifies and assesses the risks included in your strategy

6

In this section, also describe how you assess the significance of climate-related risks in relation to other risks.

How your company manages and prioritizes climate-related risks

7

How climate-related risks are integrated in your overall risk management

8

METRICS AND TARGETS

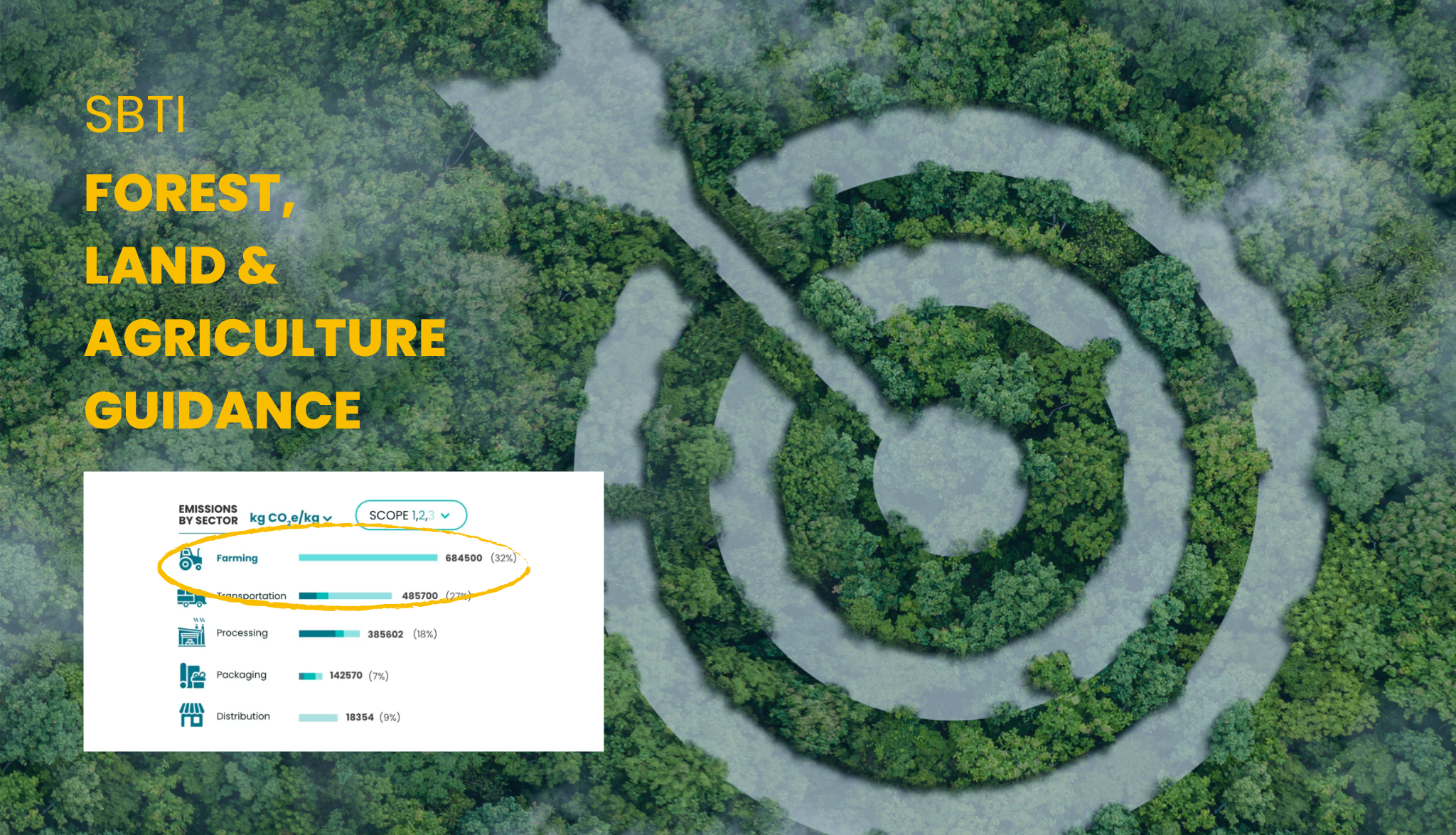

Welcome to the fundamentals! The metrics and targets section is not only the basis of your strategy development, it is also the most heavily quantified section of your TCFD-aligned report. TCFD is not too prescriptive when it comes to methodological choices. For the sake of convergence, it requests that your inventory calculations follow the GHG protocol relevant standards and categorization in Scopes 1, 2, and 3.

For food and beverage production, companies are also encouraged to include metrics on climate-related risks associated with water, energy, land use, and waste management. Careful though! TCFD is NOT requesting metrics on these impact categories but emissions metrics that may impact them.

The last 3 recommendations of TCFD outline the metrics that you choose to support your strategic planning and monitoring of your operations:

Share the metrics your company uses to assess climate-related risks and opportunities

9

These should align with your Sections B Strategy and C Risk management.

Share your Scope 1, 2, and possibly 3 GHG emissions inventory

10

Outline your targets on climate-related risks and opportunities and your yearly performance against them

11

In your target delineation, you should include both absolute and intensity targets, the time frame for each (medium-, long-term and interim targets), the base year, and the associated KPIs.

That’s the gist of it! In fact, that’s more than the gist: The recommendations document itself doesn’t include much more actionable information than the ones you just read. The best thing about the TCFD framework is that it is super user-friendly for developing a systematic climate strategy that advances your organization’s maturity. This means that the greatest beneficiary of this framework is primarily your company. We do recommend giving the TCFD recommendations a go in your next sustainability report, before you need to employ them for the mandatory climate-related financial disclosures!

More standard-explainers?

CSRD reporting: What you need to know

Preparing for CSRD reporting? Join the club of over 50,000 companies required to report on sustainability! Talking to companies preparing for CSRD, we have observed that their biggest concern is the m

ESG Reporting: Navigating ESG frameworks & requirements

Learn all about ESG reporting standards to promote transparency, impress your stakeholders, and boost your brand. What Does ESG Reporting Mean? Why Is ESG Reporting Important For Companies? Mandatory

How to set SBTi FLAG targets – The Food Edition

The Forest Land and Agriculture Guidance from SBTi had retailers and food producers on the edge of their seats until its release in September 2022. Since April 2023 FLAG targets are a requirement and

What are Scope 1,2,3 emissions?

The terms Scope 1,2,3 emissions are casually thrown around in the sustainability space – a bit too casually if you ask us. If you didn’t Google it the first time you heard it, you probably hav

ESG Standards Explained: Corporate Sustainability Reporting Directive (CSRD)

The European Union’s Corporate Sustainability Reporting Directive (CSRD) is mobilizing ESG reporting for the food and beverage market. But there is another good reason to look at CSRD closely: CSRD

Prev

Next

Related Posts

A walk in Stockholm with George Monbiot: How do we Reboot Food?

George Monbiot is one of the most influential environmental voices in the world, with a clear, factual message and a dedicated following – us at CarbonCloud included. George has a number of titles t

The Complete Guide to National Climate-Related Disclosures

5 years ago, a climate strategy was a nice-to-have, an additional brand value. 2 years ago –and for some, still– climate strategy was a long-term commitment. 2022 marks the great shift from nice-t

FAO 1.5°C Roadmap: The net-zero plan for food

Discover the FAO 1.5 °C roadmap for transforming agri-food systems and achieving sustainable goals. Explore sector-specific solutions across domains like livestock, healthy diets, fisheries, and more

How to set SBTi FLAG targets – The Food Edition

The Forest Land and Agriculture Guidance from SBTi had retailers and food producers on the edge of their seats until its release in September 2022. Since April 2023 FLAG targets are a requirement and