Voluntary carbon offsets in numbers: Money talks, volume wails

Offsetting has claimed a central position in the global challenge to reach net zero. In this article we break down the business case for offsetting with price and inventory and what your best bet is short term. Spoiler alert: It’s not the silver bullet many have hoped. First off: Let’s have a look at what the current state of the market.

Business is booming

The carbon offset market virtually exploded in 2022. In terms of monetary value, the global inventory jumped from $520 million to over $2 billion, according to Ecosystem Marketplace’s brief on the state of the market. The number of metric tonnes available for offsetting increased from 200 million to almost 500 million.

However, as described in our previous article in this series, not all offsetting programs are created equal. The largest growth was in renewable energy and forestry projects, for which both permanence and additionality is often questionable at best. A recent report from the Guardian found that 90% of projects from Verra, a global leader in forestry offsets, are “largely worthless”. If you and your company decide that offsetting is still the right path for you, let’s dive deeper into the availability of higher quality options.

Is there high-quality inventory?

CarbonCloud has combed through one of the leading offsetting aggregating platforms and found the available inventory of high-quality offsets for the year 2022. The criteria for making the list included high confidence of additionality, hundreds of years of permanence, no overestimation, full exclusivity, and no significant other social or environmental harm. Direct air capture with concrete mineralization, biochar, sustainable forestry with burying of the wood were among the projects that passed the bar. The total amount of carbon available for sequestration is just north of 3,000 tonnes. That is barely a drop of water in the ocean of emissions from the food industry, which amounted to almost 18 billion tonnes, according to Nature Food.

This of course doesn’t cover the total global inventory of high-quality offsets, but we have no reason to believe that the global total is larger by orders of magnitude. A report from the UNFCCC concludes that there were a total of 8,000 tonnes of direct air capture – one of the robust carbon offsetting options – available across the globe in 2022. Although, several projects are unavailable for offsetting because they are attached to already highly emitting industry chimneys, making them reduction efforts for the chimney owner not offsetting.

Get the full offsetting crash course

The story you are reading is part of a four step crash course in offsetting for food companies. Signup below to get the other three parts!

What happens to your business if you buy it?

The next step is to look closer at the cost. The average price of the offsetting options analyzed by CarbonCloud is $400 per tonne of CO2. This is the price you should expect to pay to be relatively sure that the project fulfills the criteria of additionality, hundreds of years of permanence, no overestimation, full exclusivity, and no significant other social or environmental harm. The total cost for the 3,000 tons of sequestered carbon totals up to $1.2 million, ripped away from your bottom line.

Let’s look at a few examples of how this would impact different food companies. The carbon footprint of each company comes from their most recent sustainability report and covers scopes 1, 2 and 3. The second column represents how much of their emissions are covered by the high-quality offsets available. The third represents the cost of offsetting each company’s full emissions, based on the average market price per ton from the project selection inventory.

|

Carbon footprint (kilotons CO2e) |

Discrepancy inventory/footprint |

Cost of full offsetting at current average price (kUSD) |

|

|

The world’s largest food company |

113,400 |

0.03% |

$ 45,346,521 |

|

Enterprise dairy alternative |

269 |

1.1% |

$ 107,568 |

|

Mid size candy producer |

251 |

1.2% |

$ 100,370 |

|

Small beverage company |

0.407 |

Full coverage |

$ 163 |

The largest actor in the entire food business emits over 100 million tonnes of CO2e per year in scopes 1, 2 and 3. The total inventory covers less than a tenth of a percent of the emissions associated with the world’s largest producer. If enough inventory suddenly appeared, the company would have to pay a staggering $45 billion – annually – to cover all its emissions. For reference, the same company showed a net profit in 2021 of $18 billion.

One of the world’s leading dairy alternative companies emits almost 270,000 tonnes of CO2e annually. The total inventory of 3,000 tonnes covers just over 1 percent of the company’s total emissions. The cost of covering the company’s total emissions with high quality offsets would be over $100 million per year. This would be added to the company’s loss of $200 million in 2021.

One of Sweden’s largest confectionery producers emits about 250,000 tonnes of CO2e annually, meaning that the high-quality offsets cover about 1.2% of its total emissions. Full coverage of its emissions would mean a cost of about $100 million per year. This cost would flip the company’s $50 million profit into a loss of the same amount.

A small energy drink producer emitted only 400 tonnes of CO2e throughout its supply chain in 2021. This means that it is fully covered by the analyzed offset projects and can even leave some credits for the rest of the industry. The cost would be $160,000. While the company’s net profit is not publicly available, it can safely be assumed that $160,000 is a significant amount of money for a company that sold half a million cans in 2021. For comparison, CocaCola sold over 31 billion bottles in 2021.

What to take with you from this scenario exercise

For companies that want to offset their current footprints, the reality is that compensating for current emissions is simply not a viable option. The current pricing and inventory of high-quality offsets are of course indicative of the early development of the technologies. But even if the astronomical cost of offsetting the total footprint is a thought experiment, the inventory discrepancy is painfully real. Food and beverage giants can offset at best a fraction of their emissions based on high-quality credits available.

The carbon offset market numbers are pointing to a clear direction: To reach our climate goals, at a global, industrial, organizational level, the most effective way is emissions reductions.

The price point also begs the question, what would it cost your business to reduce emissions instead of offsetting them? Does it make more sense to pay a premium for climate-efficient packaging? Can you source your highest emitting ingredients from a more efficient and expensive source? With the right data, the answers to these questions –and more– are easily discoverable. If you don’t have the right data, reach out below and we will help you get started!

Related Posts

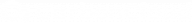

How to set SBTi FLAG targets – The Food Edition

The Forest Land and Agriculture Guidance from SBTi had retailers and food producers on the edge of their seats until its release in September 2022. Since April 2023 FLAG targets are a requirement and

Climate Action in the Food Industry: Half-Baked Efforts as 44% of Companies Remain at Initial Maturity Level

An in-depth analysis of 83 global companies in the food system reveals mixed levels of maturity along 6 dimensions of climate performance, but with a projected positive trajectory of climate action in

What makes a carbon offset?

One thing for us to say “a product cannot be carbon neutral” and expect you to take our word for it and another to present the facts. So we took the time to present the full argument in an article

The net-zero transformation is data-driven

Tackling climate change is complex and change leaders often remark that there is no silver bullet. At CarbonCloud we not only agree with this point; we actively engage with it. But something comes dar