‘Best in class’ comes with the burden of proof

A climate footprint assessment can be done for many different reasons and with different levels of ambition. Climate change is a serious problem. It is now getting the merited spotlight, and we cannot underestimate it anymore – we need to act. But to act in a meaningful way, we need information, lots of it. However, at least in this decade, we have to make peace with the fact that we need to make some decisions with incomplete information. How do we – as decision-makers within the food industry – best go about deciding on a climate strategy with an embedded level of incomplete data on where we are at and what we can do about it?

This obscurity spurs from the prematurity of the data collecting processes, not from some prematurity of the science for how to calculate. The science of how to calculate climate performance is mature; however, the practice of measuring, collecting, and documenting the necessary data for these calculations is immature and in grave need of future development.

In the case of consumables, rarely ever does anyone have complete information about their value chain to make an exact assessment of their climate footprint. There will always be details where a level of assumption is necessary. In the same vein, it is also rare that there is too little information to say anything about their climate footprint. The brand and product owners and other experts always know a lot about the product and its value chain to provide guidance to consumers on the climate effect of their purchase.

How we approach data uncertainty

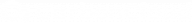

CarbonCloud’s approach to data uncertainty is to say as much as possible about each products’ climate performance, as quickly as possible and then set up an incentive structure for collecting more and better data over time, while making sure to rarely underestimate a footprint. The steps here are:

- Start quick and rough,

- Dig into the details that matter,

- Rarely underestimate a climate footprint – even in the rough and dirty version.

There is an underlying choice we have made regarding the evidence. The initial climate footprint of a product, when modeled quick and rough, will be conservative, as in probably higher than a thorough assessment would yield. A brand or product owner who is content with a conservative estimate of their value chain does not have to back up their data since they are already conservative and cover the margin of error upwards. However, for the product or brand owners who want to approach the most high-fidelity climate footprint, or claim low emissions with superlatives, the burden of proof lies with them – and this approach is in line with the stance of rarely underestimating the problem.

Newsletter to-go?

Our special today is our Newsletter, including snackable tips, hearty climate knowledge, and digestible industry news delivered to your inbox

Is there value in a rough estimate of climate footprint?

You may well ask: What is the point in an assessment if I can supply little specific data? This heavily depends on what you aim to say. A rough estimate of your climate footprint is a great way of starting the journey, becoming aware and transparent with your climate footprint, and freeing up resources to focus on what matters the most. Any additional data refinement will likely show that the climate performance is even better than the initial claim.

Additionally, highly conservative data can still result in useful commercial information as well as outcomes in operations. Let’s expand a previous statement: We rarely have too little information to say anything – starting with the ingredient category in itself. We know that a potato with the highest climate impact will have a much smaller climate footprint than the dairy cheese with the best climate performance. Combining that with the platform’s richness and detail in benchmark data always results in useful data with clear directives to improve climate performance.

Finally, starting rough provides an incentive structure for several levels of added value:

- You complete the most difficult step in climate footprint assessment: Getting started.

- You have a set-up framework to refine the assessment over time: Measure more thoroughly, request data from suppliers, and gain an increasingly better understanding of where in the supply chain the emissions occur.

In this setup, the organic next step is to engineer the actual supply chain improvements and, one-by-one, walk through the small business decisions that will decarbonize and future-proof your supply chain and production process, preparing your business for upcoming stricter climate policies.

What if I want to get closer to the true climate footprint?

Brand or product owners who want to dive deeper into the claims and highlight the hues of their climate performance need to conversely model it with a higher level of detail. As a result, they need to provide more evidence to back up said details. A brand or product owner who is content with a conservative estimation of their product does not have to provide the same level of detailed information as one who wants the lowest possible result.

A brand or product owner with high ambitions who aspires to claim that they are among the champions in climate performance needs to provide evidence that they are the positive exception. This flips the example of the potato and the cheese on its head: If a potato chips producer wants to claim a competitive edge among other potato chips or plant-based snack producers, that edge comes down to their operations rather than the ingredient choice. In this case, the data and related evidence they add in their modeling need to be much more specific.

Does this mean that all products’ footprints from the platform are grossly overestimated?

No, it does not. The better the input data for any calculation, the closer to the actual value the result is. Many producers and brand owners have near access to data, which brings the assessments really close to the true climate footprint since most or all relevant data is known. The platform also is built to guide users to focus their data collection on the processes and ingredients that matter. Some parts of the production process have a large influence on the results and other parts matter less.

Finally, as the platform crunches larger amounts of data, it learns more and more about how processes typically look and how they differ between producers of similar goods – without identifying or exposing any of the trade secrets. This means that the conservative default values get closer and closer to the specifics over time. This way, the platform will actively help to build up a collective understanding of where and how the emissions occur and will simplify a spot-on assessment for each specific product.

We began with a flaming question for every strategist in the food industry: How do you craft a climate strategy without an established data collection process? As it happens with change, the rate of response differs: There are different ambitions, different adoption, and development rates. As the goal of CarbonCloud is to support every single willing food product owner to calculate and reduce their emissions, the modeling range provides useful insights for all rates of climate development as well as the incentive structure to improve – one that reflects each food product owner’s development rate. So a food product owner cannot be a climate champion without championing the development of data collection and a climate novice is given the toolbox and roadmap to becoming a climate champion

Related Posts

Climate transparency in food supply chains: The biggest need since sliced bread?

For a third year in 2022, climate action failure takes the top spot as the highest- concerning risk in the World Economic Forum’s Global Risk Report [1]. Contributing a third of the global emissions

The net-zero transformation is data-driven

Tackling climate change is complex and change leaders often remark that there is no silver bullet. At CarbonCloud we not only agree with this point; we actively engage with it. But something comes dar

Planet A Foods sells 92% CO2e savings – and the food industry is buying

One could say that Planet A Food’s main product is CO2 savings. One could say that, if Planet A Food’s flagship product, Nocoa, wasn’t taking over the confectionery world. Planet A Food’s oat

We saw 0kg of CO2e: The case of Two Raccoons, fruit surplus, and allocating emissions

Two Raccoons are winemakers with a purpose… or rather, winemakers who give a purpose. Two Raccoons makes delicious wines from good fruit surplus which otherwise would go to waste – and collect awa